MCA Vide Order dated 30th September, 2016 has constituted expert group to examine the issues arose to the Audit Firm due to structuring of certain audit firm and to make suitable recommendation to the government on this. The expert group consist of Shri. Ashok Chawala as Chairman, Shri.Hari S. Bhartia and Shri. N.S. Vishwanathan as member of the expert group. The expert group have to complete the project within 2 months.

For more details..follow the link of the order:

Constitution of Expert Group to look into the issues related to Audit Firm

![Constitution of Expert Group to look into the issues related to Audit Firm]() Prince Kumar

October 02, 2016

Prince Kumar

October 02, 2016

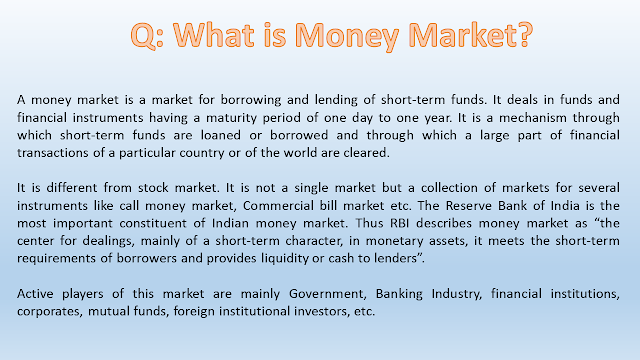

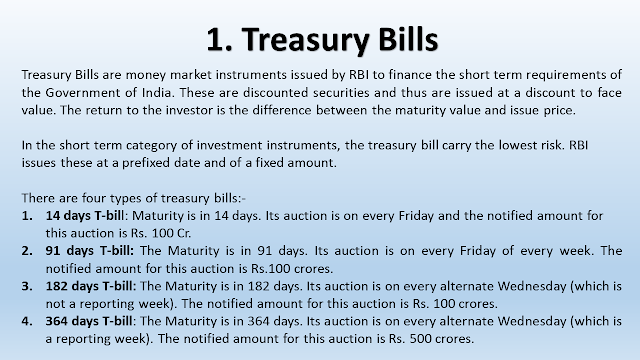

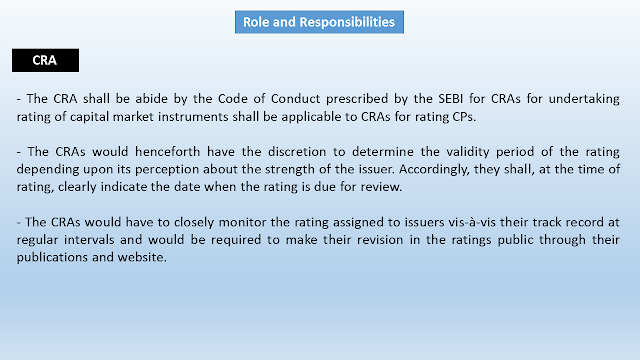

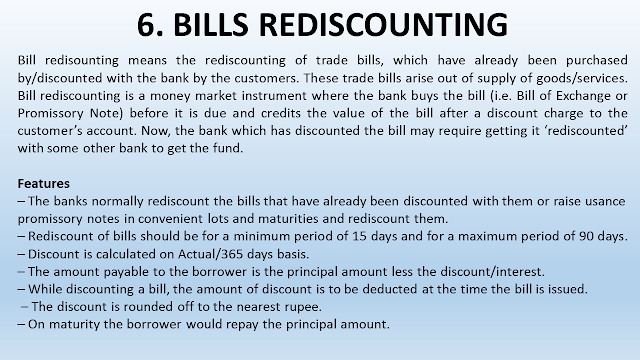

Money Market and its Instruments

Prince Kumar

October 01, 2016

Prince Kumar

October 01, 2016

Prince Kumar

October 01, 2016

Prince Kumar

October 01, 2016

National Company Law Appellate Tribunal Rules, 2016

![National Company Law Appellate Tribunal Rules, 2016]() Prince Kumar

July 24, 2016

Prince Kumar

July 24, 2016

National Company Law Tribunal Rules, 2016

![National Company Law Tribunal Rules, 2016]() Prince Kumar

July 24, 2016

Prince Kumar

July 24, 2016

MCA vide Notification dated 30th June, 2016 has notified the Companies (Appointment and Remuneration of Managerial Personnel) Amendment Rules, 2016 amending Rule 3, 5(1) and 5(2) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014.

Due to

this amendment:

1.

Return of appointment of a “Chief Executive

Officer (CEO), Company Secretary, Chief Financial Officer (CFO)” is not

required to be filled with the Registrar in Form No. MR-1.

2.

Listed Company is no more required to disclose

the following matters in its Board’s report:

i) the explanation on the relationship between

average increase in remuneration and company performance;

ii)

comparison of the remuneration of the Key

Managerial Personnel against the performance of the company;

iii)

variations in the market capitalisation of the

company, price earnings ratio as at the closing date of the current financial

year and previous financial year and percentage increase over decrease in the

market quotations of the shares of the company in comparison to the rate at which

the company came out with the last public offer in case of listed companies,

and in case of unlisted companies, the variations in the net worth of the

company as at the close of the current financial year and previous financial

year;

iv) comparison of the each remuneration of the Key

Managerial Personnel against the performance of the company;

v)

the key parameters for any variable component

of remuneration availed by the directors;

vi)

the ratio of the remuneration of the highest

paid director to that of the employees who are not directors but receive

remuneration in excess of the highest paid director during the year.

3.

The board’s report shall include a statement

showing the name of top ten employees in terms of remuneration drawn and the name

of every employee, -

(i) if employed throughout the financial year, was in receipt of

remuneration for that year which, in the aggregate, was not less than one crore

and two lakh rupees;

(ii) if employed for a part of the financial year, was in receipt

of remuneration for any part of that year, at a rate which, in the aggregate,

was not less than eight lakh and fifty thousand rupees per month;

(iii) if employed throughout the financial year or part thereof,

was in receipt of remuneration in that year which, in the aggregate, or as the

case may be, at a rate which, in the aggregate, is in excess of that drawn by

the managing director or whole-time director or manager and holds by himself or

along with his spouse and dependent children, not less than two percent of the

equity shares of the company.

Companies (Appointment and Remuneration of Managerial Personnel) Amendment Rules, 2016

Prince Kumar

July 06, 2016

Prince Kumar

July 06, 2016

Prince Kumar

July 06, 2016

Prince Kumar

July 06, 2016

|

RBI decides to simplify and rationalise the process of registration of new NBFCs | |

|

RBI relaxes the norms for NBFC registration

Prince Kumar

June 22, 2016

Prince Kumar

June 22, 2016

Prince Kumar

June 22, 2016

Prince Kumar

June 22, 2016

Model GST Law

![Model GST Law]() Prince Kumar

June 15, 2016

Prince Kumar

June 15, 2016

| Prudential Norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances – Spread Over of Shortfall on Sale of NPAs to SCs/RCs | |

|

Prudential Norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances – Spread Over of Shortfall on Sale of NPAs to SCs/RCs

![Prudential Norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances – Spread Over of Shortfall on Sale of NPAs to SCs/RCs]() Prince Kumar

June 14, 2016

Prince Kumar

June 14, 2016

RBI introduces a ‘Scheme for Sustainable Structuring of Stressed Assets’ | |

|

Scheme for Sustainable Structuring of Stressed Assets

![Scheme for Sustainable Structuring of Stressed Assets]() Prince Kumar

June 14, 2016

Prince Kumar

June 14, 2016

Application of Cost Records

- The companies, including foreign company engaged in the production of the goods or providing services as specified and having overall turnover from all its goods and services of Rs. 35 Crores or more during immediately preceding financial year, shall include cost records for such products or services in their books of accounts.

- The specified company has been divided into 2 groups namely:

(a) Regulated sectors

(b) Non-Regulated sectors

REGULATED SECTORS

- - Telecommunication services

- - Generation, transmission, distribution and supply of electricity

- - Petroleum products

- - Drugs and Pharmaceuticals

- - Fertilisers

- - Sugar and industrial alcohol.

NON-REGULATED SECTORS

- - Machinery and mechanical appliances used in defence, space and atomic energy.

- - Turbo jets and turbo propellers

- - Arms and ammunitions

- - Propellant powders, safety fuses, detonating fuses, percussion or detonating caps, igniters and electric detonators

- - Radar apparatus, radio navigational aid apparatus and radio remote control apparatus

- - Tanks and other armoured fighting vehicles

- - Port services

- - Aeronautical services

- - Steel

- - Roads and other infrastructure projects as per Sch. VI of Companies Act, 2013

- - Rubber and allied products

- - Coffee and tea

- - Railway or related instruments/ services

- - Cement

- - Ores and minerals products

- - Mineral fuels, mineral oils, etc

- - Base metals

- - Inorganic Chemicals, organic or inorganic compounds

- - Jute and jute products

- - Edible oil

- - Construction Industry as per para no. (5)(a) of Sch. VI of the Companies Act, 2013

- - Health services

- - Education services

- - Milk powder

- - Insecticides

- - Plastics and polymers

- - Tyres and tubes

- - Paper

- - Textiles

- - Glass

- - Other machinery

- - Electricals or electronic machinery

- - Production, import and supply or trading of specified medical services.[This shall not apply to foreign companies having only liaison offices]

- The provision of cost audit is not applicable to a company classified as a micro enterprise or a small enterprise including as per the turnover criteria under sub-section (9) of section 7 of the Micro, Small and Medium Enterprises Development Act, 2006.

|

Applicability of Cost Audit

- Every company falls under regulated sectors shall have to get its cost records audited if from its products and services :

Overall turnover ≥ Rs. 50 cr.

AND

Aggregate turnover of ≥ Rs. 25 Cr.

individual products/ services

- Every company falls under non-regulated sectors shall have to get its cost records audited if from its products and services :

Overall turnover ≥ Rs. 100 cr.

AND

Aggregate turnover of ≥ Rs. 35 Cr.

individual products/ services

- The company which are required to maintain cost records shall not required to get its records audited, if

(a) revenue of the company from exports, in foreign exchange, exceeds 75% of its total revenue; or

(b) the company is operating from SEZ.

Maintenance of Records

- Cost records shall be maintained on regular basis in such a manner as to facilitate calculation of per unit cost of production or cost of operations, cost of sales and margin for each of its products and activities for every financial year on monthly or quarterly or half-yearly or annual basis.

- The cost records shall be maintained in such manner so that it helps in optimum utilization of resources.

Cost Audit

- The company shall appoint Cost Auditor within 180 days of the commencement of the financial year.

- Company shall inform the Cost Auditor of his appointment and file a notice of such appointment to the Central Government within 30 days of the Board meeting in which appointment is made or 180 days of the commencement of the financial year, w.e. earlier through e-form CRA- 2.

- Every Cost Auditor shall continue in such capacity till the expiry of 180 days from the closure of the financial year or till he submits the Cost Audit Report for the financial year for which he has been appointed.

- Any casual vacancy (resignation/ death/ removal) in the office of a Cost Auditor shall be filled by the Board of Directors within 30 days and the company shall inform the Central Government in e-Form CRA-2 within 30 days of such appointment of cost auditor.

- Cost Auditor shall forward his report along with reservation or qualification or observation or suggestion, if any in Form CRA-3 to the Board of Directors of the company within 180 days from the closure of the financial year.

- The Board shall examine and consider the report and file a copy to the Central Government within 30 days of the receipt of the report through e-form CRA-4 along with the full information and explanation on every reservation or qualification contained in the report.

Note:

- The cost audit shall be conducted by a Cost Accountant in practice.

- Cost Auditor is appointed by the Board of Directors.

- Cost Auditor and statutory shall not be same.

- Cost Auditor shall comply with the Cost Accounting Standards.

- Fine & penalty is same as provided in Section 147 read with the Rule 9 of the Companies (Audit and Accounts) Rules, 2014.

Cost Audit and Auditors

Prince Kumar

June 14, 2016

Prince Kumar

June 14, 2016

Prince Kumar

June 14, 2016

Prince Kumar

June 14, 2016

VARIOUS FORMS UNDER COMPANIES ACT,

2013

Forms of Chapter II

INC-1 –Application for

reservation of name

INC-2- Form for

Incorporation and nomination (One Person Company)

INC-3- Form for consent of

nominee of One Person Company

INC-4- Form for change in

member/nominee of One Person Company

INC-5- Form for intimation

of exceeding threshold of One Person Company

INC-6- Application for

Conversion

INC-7- Application for

Incorporation of Company (Other than One Person Company)

INC-8- Declaration from the

professional as to compliance

INC-9 – Affidavit from

subscribers

INC-10- Form for

verification of signature of subscribers by witness.

INC-11 – Certificate of

Incorporation

INC-12 – Application to C.G

by Section 8 Company for not using the word “Limited” in its name

INC-13- Memorandum of

Association

INC -14 & INC-15 –

Declaration regarding section 8 Company

INC-16 & 17- Licence

under Section 8 Company

INC-18- Application to

Regional Director for conversion of section 8 company into any other kind of company

INC-19 – Notice by

applicant under Section 8

INC-20 - Intimation to

Registrar of revocation or surrender of license issued under section 8

INC-21- Declaration prior

to the commencement of business

INC-22- Notice of situation

or change of situation of registered office and verification

INC-23- Application to

Regional director for approval to shift the registered office from one state to another state or from

jurisdiction of one registrar to another within the state

INC-24- Application for

approval of Central Government for change of name

INC-25- Certificate of

incorporation pursuant to change of name

INC-26 – Advertisement to

be published in newspaper for licence for existing companies

INC-27- Conversion of

public company into private company or private company into public company

INC-28- Notice of order of

the Court or other authority

INC-29- Integrated form for

the incorporation of companies except section 8 company.

Forms of Chapter III

PAS 1-

Advertisement giving the details of special resolution varying the terms of

contract referred in the prospectus.

PAS 2-

Information Memorandum

PAS 3- Return of

allotment

PAS 4- Private

placement offer letter

PAS 5- Record of

private placement offer

Forms of Chapter IV

SH 1 – Share Certificate

SH 2- Register of renewed

or duplicate share certificates.

SH 3- Register of Sweat

equity shares.

SH 4- Securities transfer

form

SH 5- Notice for transfer

of partly paid-up shares

SH 6 – Register of Employee

Stock Option

SH 7- Notice to Registrar

for alteration of share capital

SH 8- letter of offer

SH 9- Declaration of solvency

SH 10 – Register of Securities bought

back

SH 11- Return in respect of buy back of

securities

SH 12- Debenture Trust Deed

SH 13- Nomination form

SH 14- Cancellation or variation of

nomination

SH 15- Certificate of compliance in

respect of buy back of securities.

Forms of Chapter V

DPT 1- Circular in the form

of advertisement inviting deposits

DPT 2- Deposit Trust deed

DPT 3 – Return of Deposits

DPT 4 – Statement regarding

deposits existing on the commencement of the Act

Forms of Chapter VI

CHG 1- Application for

registration of creation, modification of charge (other than those related to

debentures) including

particulars of modification of charge by Asset Reconstruction Company in terms

of Securitization and Reconstruction

of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI)

CHG 2- Certificate of Registration of

charge.

CHG 3- Certificate of registration of

Modification of Charge

CHG 4- Particulars for satisfaction of

charge

CHG 5- Memorandum of satisfaction of

charge.

CHG 6- Notice of appointment or

cessation of receiver or manager

CHG 7- Register of charges

CHG 8- Application for condonation of

delay to the Central Government.

CHG 9- Application for registration of

creation or modification of charge for debentures or rectification of particulars filed in respect of

creation or modification of charge for debentures.

Forms of Chapter VII

MGT 1- Register of Members

MGT 2- Register of

debenture holders/other security holders

MGT 3- Notice regarding

place of keeping the registers

MGT 4- Declaration of

beneficial interest (by registered owners)

MGT 5- Declaration of

beneficial interest by persons holding beneficial interest.

MGT 6- Return to registrar

regarding beneficial interest.

MGT 7- Annual Return

MGT 8- Certificate by

Company Secretary in Practice

MGT 9- Extract of Annual

Return

MGT 10 – Changes in the

shareholding position of promoters and top ten shareholders.

MGT 11- Proxy form

MGT 12 –polling paper

MGT 13- Report of the

Scrutinizer

MGT 14- Filing of

Resolutions and agreements to the Registrar under section 117.

MGT 15- Form for filing the

report on AGM.

Forms of Chapter VIII

No forms prescribed

Forms of Chapter IX

AOC 1- Statement containing

salient features of the financial statement of subsidiaries/ associate

companies/joint ventures

AOC 2- Related party disclosure

AOC 3- Statement containing

salient features of Balance Sheet and Profit and Loss Account

AOC 4- Form for filing

financial statement and other documents with the registrar.

AOC 5- Form to intimate the

place of keeping the books of accounts and other documents at a place other

than the registered office.

Forms of Chapter X

ADT 1- Notice of

appointment of Auditors

ADT 2- Application for

removal of auditors before the expiry of term.

ADT 3- Notice of

Resignation of Auditor

ADT 4- Report to Central Government,

suspecting offence involving fraud.

Forms of Chapter XI

DIR 1- Application for

inclusion in databank of independent directors

DIR 2- Consent to act as

director

DIR 3- Application for

allotment of Director Identification Number

DIR 4- verification of

applicant for application for DIN

DIR 5- Application for

surrender of DIN

DIR 6- Intimation of change

in particulars of Director to be given to the Central Government

DIR 7- Verification of

applicant for change in DIN particulars

DIR 8- Intimation by

director about other directorships / previous disqualification if any etc.

DIR 9- report by a company

to registrar

DIR 10 – For of application

for removal of disqualification.

DIR 11- Notice of Resignation of Director to the Registrar.

DIR 12- Particulars of Appointment of Directors, Key Managerial

Personnel and Change amongst them.

Forms of Chapter XII

MBP 1- Notice of interest

by Director

MBP 2- Register of loans

etc

MBP 3- Register of

investments not in own name

MBP 4- Register of

contracts with related party.

Forms of Chapter XIII

MR 1- Return of appointment of managing director or whole time

director or manager

MR 2- Form of application to the Central Government for approval of

appointment or reappointment and remuneration or increase in

remuneration or waiver for excess or over payment to managing director or whole time director or manager

and commission or remuneration to directors

MR 3- Secretarial Audit Report

Forms of Chapter XXI

URC 1- Application by a

company for registration under section 366

URC 2- Advertisement giving

notice about registration under Part I of Chapter XXI

Forms of Chapter

XXII

FC 1- Information to be

filed by foreign company

FC 2- Return of alteration

in the documents filed for registration by foreign company

FC 3- List of all principal

places of business in India established by foreign company

FC 4- Annual Return

Forms of Chapter

XXIV

GNL 1 Form for filing an

application with Registrar of Companies

GNL 2 Form for submission

of documents with Registrar of Companies

GNL 3 Particulars of

person(s) or director(s) or charged or specified for the purpose of section

2(60)

Forms of Chapter

XXVI

NDH 1- Return of statutory

compliances

NDH 2- Application for

extension of time

NDH 3- Half yearly Return

Forms of Chapter

XXIX

ADJ - Memorandum of Appeal

MSC 1- Application to ROC

for obtaining the status of dormant company

MSC 2-

Certificate of status of a Dormant Company

MSC 3- Return of dormant

companies

MSC 4- Application for

seeking status of active company

MSC 5- Certificate of

Status of an Active Company

Note:

If you are facing any other problems while filing any forms or need any

assistance, do write to us or chat online through the gateway appearing on the bottom left of the screen; we will assist you in all possible manner. (note: online chatting facility is not available on mobile version)

Best regards,

Prince Kumar

csprincekumar@gmail.com

Forms under Companies Act, 2013

![Forms under Companies Act, 2013]() Prince Kumar

June 13, 2016

Prince Kumar

June 13, 2016